Re: Americas Financial Future

[QUOTE=zbuckz_lloyd;99178]

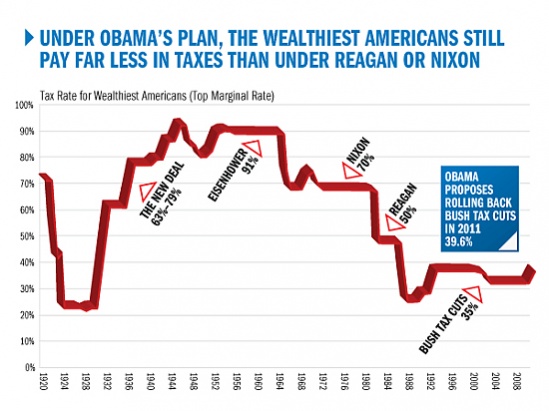

But, do we really have a deficit problem? Look at the time after World War II. In 1945 the deficit was 120% of GDP. Right now it is 97%. How did they deal with the deficit crisis in 1945. They raised taxes and invested in infrastructure, the exact opposite of what the Republicans want now. They actually spent money. What happened? Unemployment dropped to an almost low under Eisenhower in the early 50’s.

Here is the million dollar question - what was the highest tax rate under Eisenhower? The answer may shock those that don’t know…[/QUOTE]

(Let’s leave out the point that the Eisenhower years ended in a recession, which was severe enough so that voters elected John F Kennedy because they wanted a change — and who subsequently lowered marginal income tax rates to spur the economy)

Keep in mind — in the Eisenhower years, no states had an income tax. Nor had Medicare been established, and Social Security taxes were much much lower. So it’s very misleading to point to today’s top tax rate of 35% and claim the upper class are paying few taxes.

Let’s take as an example, New York where the top state income tax rate is 8%.

Someone’s effective top marginal tax rate in the Empire State would therefore be 35% + 8% + 7.5% Medicare Payroll Tax + 7.5% Social Security Payroll Tax.

Leaving out New York City’s personal income tax, they’re effective tax rate is 58%.

Another difference between the Eisenhower years and today is that in those days it wasn’t a complete breeze to set up residences, off-shore accounts or move. I get DVD’s from United States porn companies whose 2257 information shows them registered in places like Cyprus, the Netherlands, etc.

I get info from producers located in Quebec, Canada, but sure enough, they sure as hell aren’t incorporated there.

Today’s world means that countries who institute taxes will immediately face competition from other jurisdictions. This, once again, reinforces my point that the Laffer Curve is correct. When tax rates increase, there is not necessarily an increase in revenues because those effected modify their behavior.

Everyone responds logically to incentives.

Steve